In this post we talk about how to create GST Input Credit adjustment entry in TallyERP.9. May be you all file your GST Return to your own or filed by your Chartered accountant or advocate.

But do you know how to show exact tax liability in your GST returns like GSTR 3B, GSTR 1, GSTR 2. It is only possible through Adjustment entry used in Tally.

For Example:

Sumit Kumar purchase goods worth Rs. 1000 taxable @ 5% and tax of Rs. 50, total of amount of Rs. 1050. In this case Rs. 50 is our input tax credit which is use to reduce our output tax liability.

Now Sumit Kumar sold same goods worth Rs. 1500 taxable @ 5% and tax of Rs. 75.

Now following conditions will be apply:

Output Liability - Rs. 75

Input Credit - Rs. 50

Net Payable - Rs. 25

In this case, Rs. 25 will be payable to department but how can we show the above condition exactly in Tally.

See below image for Input Credit Entry

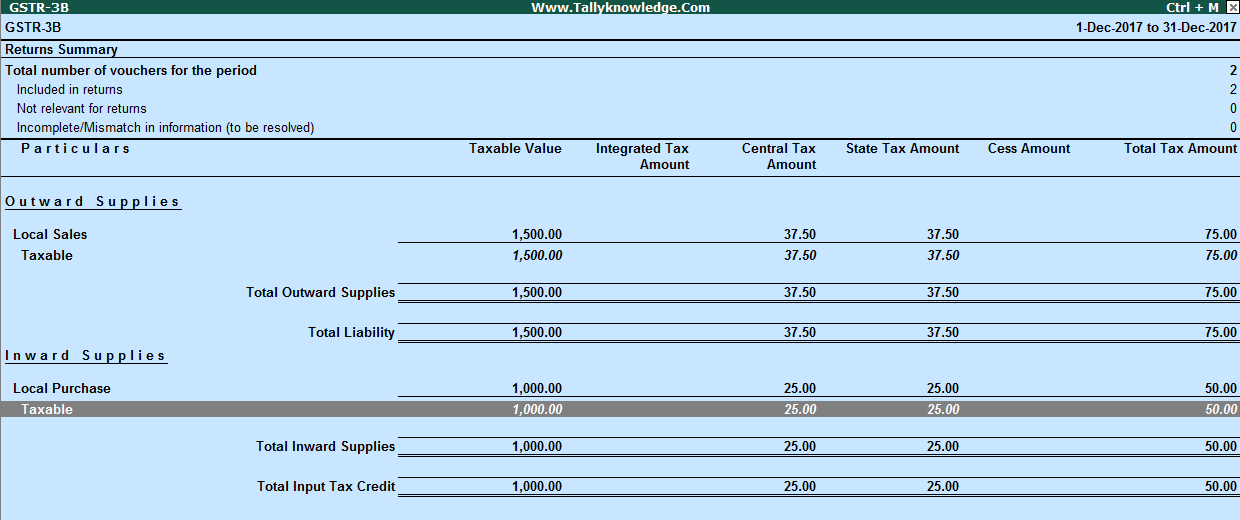

Above entry create Input Credit of Central Tax and State Tax and it is appear in GSTR 3B and GSTR 2 as follows:

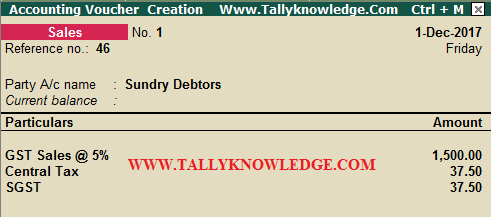

Now its time for output liability, create sales voucher as follows:

Output liability will shown in GSTR 3B or GSTR 1 as follows:

In above image we have output liability of Rs. 75 (CGST 37.50 and SGST 37.50 each) and input credit of Rs. 50 (CGST 25 and SGST 25 each) and hence our net tax liability is Rs. 25 (CGST 12.50 and SGST 12.50). But it is not showing.

Now we create Journal adjustment Entry. Go to accounting vouchers and press F7 for Journal Voucher, now press Alt + J for Statutory adjustment. It will show you to do adjustment fot GST Liability.

Select GST - Decrease of Tax Liability - Adjustment against Credit and pass following Entry.

This entry will take effect of Input Credit adjustment with output liability in your GSTR 3B.

You can see our net liability is reduced in above image.

In next post we talk about adjustment of IGST with CGST and SGST and other input credit adjustments.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.