As you know, GST was implement from 1st July, 2017 and after this the whole accounting process was changed. In VAT & other tax regime there is some certain cases of input credit and there was no requirement for maintain stock monthly. But after GST you can claim input tax credit on almost each expenses.

For Example, credit always available on trading goods purchase for business, but you can claim input on the expenses which will be use in furtherance of business like telephone expenses, printing &stationery, bank charges etc. For claiming input tax credit you need to pass journal voucher and enter the input amount manually.

But in this post we teach you to how to get input credit through purchase entry instead of passing journal & how to maintain your direct or indirect income also and generate output liability.

In our previous post Manage accounts with or without Inventory we discuss for manage inventory and If you using inventory then you can enter Sales / Purchase with inventory & you can also use income / expenses in sales/ purchase voucher.

There is three type of voucher invoice of Sales / Purchase you can enter.

- As voucher

- Item Invoice

- Accounting Invoice

As Voucher

As a voucher mode, you can enter normal voucher entry, you can use the inventory in voucher mode but GST will not calculate in this mode automatically. You need to enter tax amount manually. As this is only voucher mode, there is also some restriction to prepare the proper GST Invoice. Like you cannot enter box details, discount details, mrp details etc. Normal Voucher mode is look like this:

This is sale invoice example of normal voucher mode, below is of purchase voucher mode:

Item Invoice

Item invoice is use for manage inventory. To use Item invoice press Ctrl + I to activate item invoice in sales purchase voucher.

Through Item invoice you can use lots of feature to generate a perfect invoice. You can use to enter total no. of box/ cartons, discount details, inventory price, price level for each customer, automatic GST calculation on multiple inventory rates, discount details on inventory and off inventory. You can make GST Invoice in Item Invoice mode with additional supplementary details, order details, dispatch details, payment mode and terms etc. To create a perfect GST Invoice read below link.

The same can be create for purchase voucher Item Invoice.

Accounting Invoice

This is last and very useful voucher mode for claiming input tax credit on purchase / expenses. This voucher is also use to enter income voucher and calculate automatically output GST on income. Press Ctrl + I for Accounting Invoice. GST tax will automatically calculate in accounting invoice mode.

Accounting Invoice voucher mode is very useful service providers like Chartered Accountants, Advocate and other service providers. Because service providers does not have any inventory with their accounts.

To create Service Invoice read this article: How to Create GST Service Invoice in Tally?

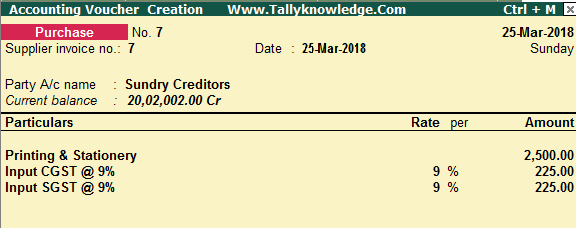

For claiming Input credit on expenses used in furtherance of business:

In above entry we claim input credit @ 9% each of CGST and SGST on expenses. As we already mention that GST will be calculate automatic in Accounting Invoice mode so there is very rare chances of wrong input credit taken for GST Returns.

Same can be done as sales Accounting Invoice vouchers.

Hope you like our post. Please like and subscribe our youtube channel also to click here : TallyKnowledge

1 Comments

Tally erp 9 all about GST and TDL customization

ReplyDeletehttp://www.youtube.com/c/ShajanKJ

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.