A taxpayer is eligible to receive an income tax refund when excess taxes have been paid by him either through tax deduction on payments made to him or direct tax payments as advance or self-assessment tax.

A taxpayer is eligible to receive an income tax refund when excess taxes have been paid by him either through tax deduction on payments made to him or direct tax payments as advance or self-assessment tax. A refund may arise under various scenarios – lesser taxable income than earlier envisaged, additional deductions/ exemptions that may not have been projected earlier etc.

In recent times, the Income Tax Department (ITD) has implemented several measures to process refunds on an ‘auto’ mode through the CPC. The process is being streamlined and there has been focus towards further improvements to make refunds hassle-free for taxpayers. However, there could be several instances where an individual faces challenges in getting refunds.

It’s important to follow some simple steps to claim the refund of excess taxes paid:

The first step is to file the income tax return for the AY and e-verify the same immediately. Once the tax return is filed and e-verified by the taxpayer, the return of income would be taken up for further processing by the ITD and an intimation would be sent intimating if the return is accepted as filed and the refund due for the year.

Tracking income tax refund status: In case of delay in issue of refund or if the taxpayer has not received the refund claimed on the tax return within a reasonable period of time, he/she could check the status of the same by following any of the below options:

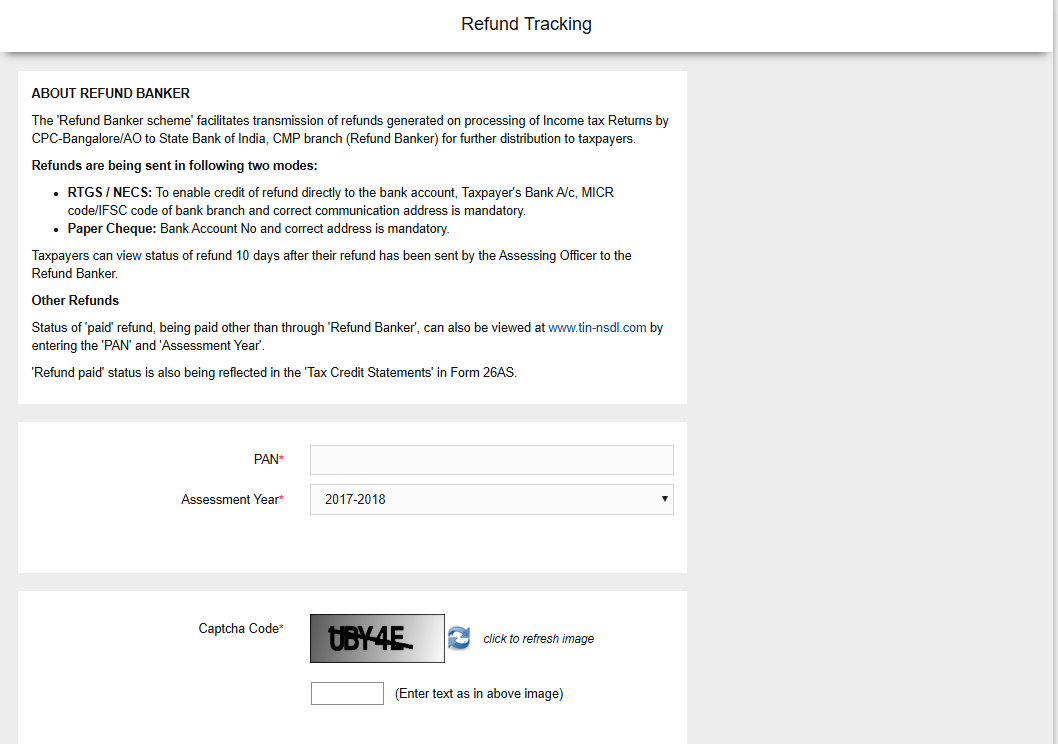

- Taxpayer may visit https://tin.tin.nsdl.com/oltas/refundstatuslogin.html. The PAN number and the AY for which the refund is due needs to be filled and submitted to find out the refund status, or

- The taxpayer may log in to his/her income tax account in the income tax portal and click on My accounts Refund/Demand Status and enter the relevant AY for which refund status to be checked.

A taxpayer has to keep a note of the following points while analysing the refund status:

- Outstanding Income tax demands: The ITD, while processing the tax return, would check the details of outstanding tax demand pertaining to the taxpayer for any of the earlier years. In case of any outstanding tax demand reflecting against the taxpayer’s PAN, communication would be sent to take necessary actions to get the tax demand nullified. If no action has been taken by the taxpayer on such tax demands, the refund due for the AY would be adjusted with the outstanding tax demands of earlier years. In order to minimise the time involved in refund processing by the ITD, it is advisable for the taxpayer to verify the outstanding tax demands for earlier years in advance and take necessary action without waiting for the communication to be received from ITD so that the refund can be issued quickly. This process is enabled by the ITD through the details made available year by year on the IT portal.

- Pre-validation of bank account: As per the new process of refund issue, it is required for a taxpayer to pre-validate his/her bank account in his/her account in the income tax portal to get the refund amount directly credited to the designated bank account. Hence, the taxpayer has to ensure that pre-validation of bank account is completed at the time the return is filed or before the processing of the return by the CPC.

- Transfer of return of income to Jurisdictional tax officer: Sometimes it so happens that the tax return filed for the year is transferred to the tax officer who has jurisdiction over the PAN of the taxpayer from CPC, Bengaluru for verification of claims made in the income tax return. In such cases, meeting of tax officer and follow-up on refund is required to speed up the refund issue process. It is vital to keep all details at hand to substantiate claims made in the return so that prompt action may be taken in response to queries raised by the officer.

- Filing of grievance petition: A taxpayer can also file a Grievance Petition (GP) in his/her account on the income tax portal to seek resolution from CPC, Bengaluru or the jurisdictional tax officer (in case of transfer of return to jurisdictional tax officer) on the refund issue.

There are technical issues that are faced by taxpayers in certain cases, where the matter may need to be raised with the CPC for necessary action. For instance, in case of a foreign national who has repatriated to his home country, post validation of the bank account, a taxpayer is required to complete an online refund reissue request to receive the refund into a pre-validated India account. This process requires an e-verification either through Aadhaar OTP or Digital Signature. These options are not feasible in case of repatriated foreign nationals as they do not hold an Aadhaar card/India mobile number or DSC. Suitable solutions to address such challenges will need to be provided by the ITD.

A proactive approach by the taxpayer in filing tax returns on time and taking necessary actions, as mentioned above, would help in processing refunds on time

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.