GST Council Committee recently reduce lots of commodity rates from 18% to 12%, 12% to 5% and 5% to Nil on Dated 10th November 2017. Commodity like Electronic Goods (Wire, Insulators, Electrical boards etc) reduced from 28% to 18%.

In this post we know how to change effective rate and effective date of a commodity and how can it effect your GST calculation.

For Setup new GST Rates you need to change / alter your existing commodity.

To Change Inventory go to Inventory Info - Stock Item - Alter

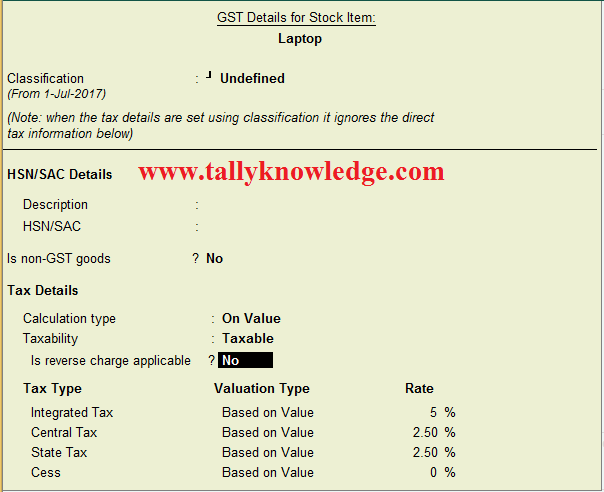

In Alter screen, you need to Select again yes to GST applicable. After selecting yes a new window for alteration of GST Classification appear on your screen as following images:

Image 1

At Place of Tax Type Change the revised rate as applicable (which is change by GST council). When you save the details system ask you to enter effective details:

Save the details and re-open the inventory details. Again go to Stock GST Details and Press Alt + L on GST Details for Stock Item. Alt + L is used to see tax rate history for each commodity.

Tax rate history show you the details of all tax rate details:

If you want to see the Original Tax Rate effect then you must enable yes to Last Option Set/ Alter Tax Details and it will show you the effective date and all the changes applicable to the commodity.

For more information see below video:

Save the details and re-open the inventory details. Again go to Stock GST Details and Press Alt + L on GST Details for Stock Item. Alt + L is used to see tax rate history for each commodity.

Tax rate history show you the details of all tax rate details:

If you want to see the Original Tax Rate effect then you must enable yes to Last Option Set/ Alter Tax Details and it will show you the effective date and all the changes applicable to the commodity.

For more information see below video:

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.