We have lots of queries about reverse charge entries in Tally. Now there is several items on which Reverse Charge is applicable. As per GST rules, reverse charge liability is payable on service recipient.

For Example:

Advocate Services is under Reverse Charge Mechanism, so if i hire advocate and receive any kind of services worth Rs. 15000 from advocate then tax liability will be raised on me (In case of Intra State Services).

Dr. Legal / Advocate Services - 15000/-

Cr Advocate / Advocate Firm - 15000/-

Reverse Charge on Advocate Services is 18% and in above transaction we do not have any tax liability, so we need to pass another entry:

Dr. Tax on Reverse Charge (15000*18%) - 2700/-

Cr CGST Output (15000 * 9%) - 1350/-

Cr SGST Output (15000 * 9%) - 1350/-

Above transaction raise tax liability of Central Tax and State Tax and also stand input credit on Reverse charge in "Tax on Reverse Charge" Ledger.

Now at the time of reverse charge payment you need to select tax liability ledger and entry is as follows:

Dr CGST Output (15000 * 9%) - 1350/-

Dr SGST Output (15000 * 9%) - 1350/-

Cr. Bank - 2700/-

This entry will setoff your tax liability and your reverse charge entry will be done at this end.

In Tally how we do above transactions which will appear in our GSTR 3B correctly.

First Entry will be as follows:

When you enter the amount just press Enter and tax classification details appear on your screen, select Purchase from Unregistered Dealer - Taxable and Select Yes to Is Reverse Charge applicable. This option will automatically calculate Reverse Charge tax in your voucher and show you hidden tax liability which will only be show in GSTR 3B

If above option is not coming in your Tally then press F12 on Tax Classification details and select all options yes.

Now Press Alt + A or click on Tax Analysis on right side bar:

Cr. Bank - 2700/-

This entry will setoff your tax liability and your reverse charge entry will be done at this end.

In Tally how we do above transactions which will appear in our GSTR 3B correctly.

First Entry will be as follows:

(Note: All reverse charge and input credit entry must be pass in Purchase Voucher, it will help you to calculate the tax automatically and and fulfill your compliance requirements).

Entry No 1When you enter the amount just press Enter and tax classification details appear on your screen, select Purchase from Unregistered Dealer - Taxable and Select Yes to Is Reverse Charge applicable. This option will automatically calculate Reverse Charge tax in your voucher and show you hidden tax liability which will only be show in GSTR 3B

If above option is not coming in your Tally then press F12 on Tax Classification details and select all options yes.

Now Press Alt + A or click on Tax Analysis on right side bar:

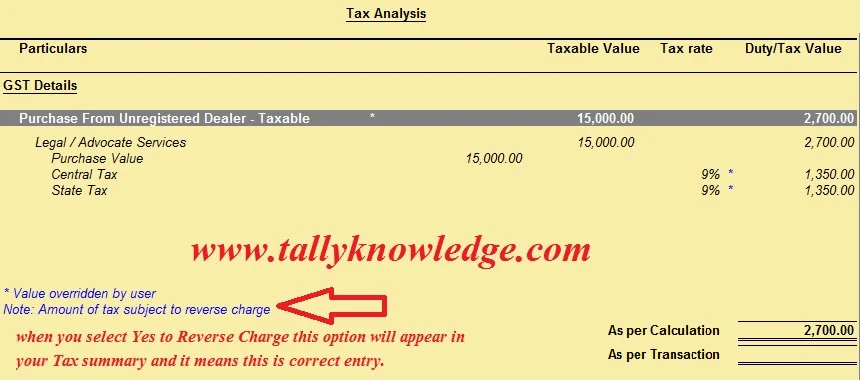

Following tax analysis appear on your screen:

Now save your entry. This entry will comply the reverse charge liability in your GSTR 3B for filing GST Return. Export JSON file and upload on GST portal. Tax liability and input Credit of Reverse Charge will automatically be appear in GST Return.

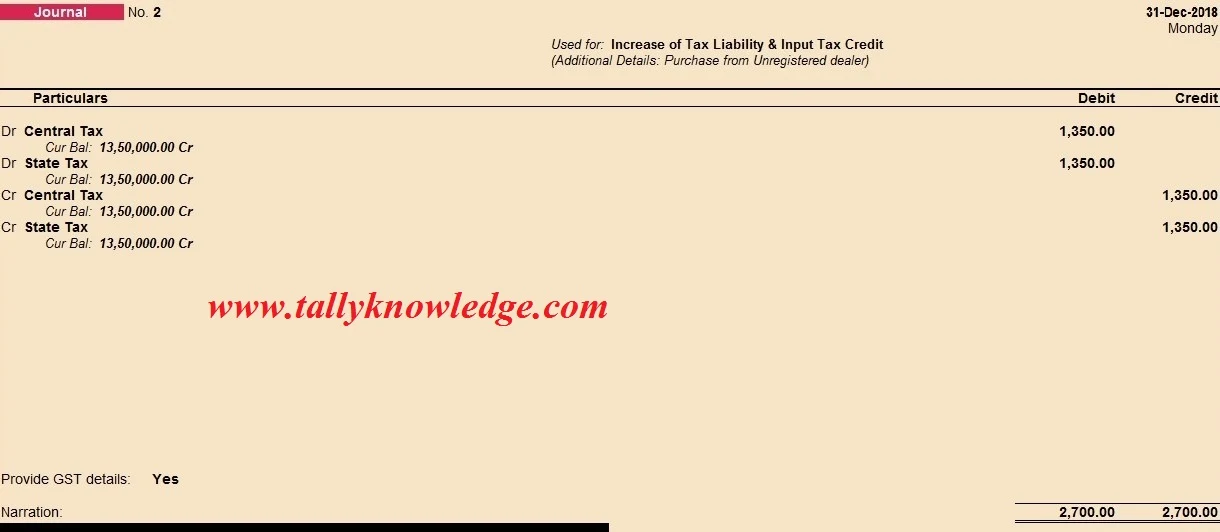

For books tax liability you need to create a new journal voucher and press Alt + J for statutory adjustment and select Statutory details as per below image:

This entry will increase tax liability and stand input credit in your books.

Now time to payment to Reverse Charge. Create payment voucher and press Alt + S or click on Stat Payment on right side bar.

Select yes to provide GST details and enter challan details as required in entry.

Payment of Reverse Charge will show in Debit side in your ledger and you can avail this amount as input credit.

For more details, please watch this video (In Hindi):

Please Subscribe our youtube channel for more videos on: Tally Knowledge Youtube Channel

If you have any doubt towards reverse charge entry you can mail us at tallyknowledge@gmail.com or post us at facebook.com/tallyknowledge or whatsapp us on 8920287934

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.