How to Create a GST Taxable POS Invoice in Tally?

Creating a POS Invoice in Tally is not much difficult. POS Invoice is Point of Sale Invoice generally use in Stores, Mega Malls, Grocery Stores (like big bazar, reliance store, etc.)

POS invoice contains multiple payment mode. I think everyone do shopping in Big Stores and malls, at the time of payment some time we pay half cash and half from credit card, debit card or any other source. So POS Invoice showing all these payment methods.

In this post we know about how to create a pos invoice with GST (Goods & Service Tax) Tax.

Before starting read below post to know about POS Invoicing

How to Create POS Invoice with GST Tax Effect.

First of all you have to enable POS Invoicing in Tally & the method is as below:

Go to Gateway of Tally - Accounting Info - Voucher Types - Create (See below image)

Do you know current tally release 6 have all the pre allocate features of POS Invoice like payment received from multiple options through credit card, cash, cheque, gift vouchers etc.

First of all you have to enable POS Invoicing in Tally & the method is as below:

Go to Gateway of Tally - Accounting Info - Voucher Types - Create (See below image)

Do you know current tally release 6 have all the pre allocate features of POS Invoice like payment received from multiple options through credit card, cash, cheque, gift vouchers etc.

For Example:

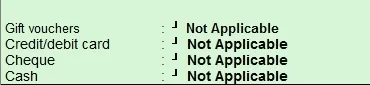

Customer A purchase 10 packets of maggi from big bazar for Rs. 140 including CGST & SGST of Rs. 20. Customer A pay Rs. 90 Cash & Rs. 50 for Cash Voucher or any other method. Big bazar shopkeeper put all the details in this pos invoice to make the payment correct. Entry will be look like below image:

Press Enter to Save the voucher and print 2 copies, one for customer and second for Records. Print preview of the bill is as below:

You can see there is two type of payment option available in Sale voucher (Invoice). You can enter each item in all 4 payment options (Credit Card, Gift Voucher, Cheque Payment & Cash) in POS Invoice.

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.