Sale to consumer is end user sales of your goods and services. In GST, there is two type of consumer sales Exempt or Taxable. Consumer sales is comes in your GSTR -1 under table no. 6 & 7 for B2C Large Invoice and B2C Small Invoice.

To Create B2C sales or sales to consumer you have need to define your buyer as a consumer. Go to Accounting Info - Ledger - Create / Alter. In Set / Alter GST Details, Select consumer in Registration type and save the buyer details.

Go to Gateway of Tally - Accounting Voucher - Sales (F8).

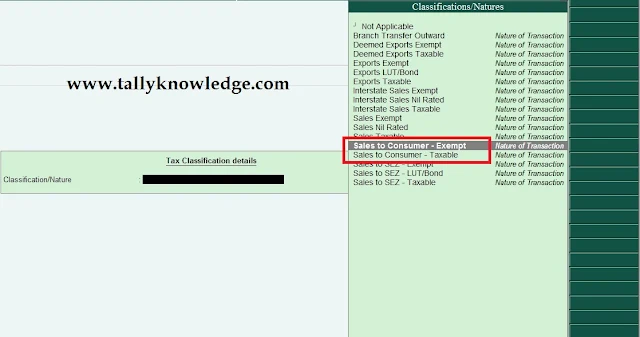

In Tax Classification details Select to Consumer - Exempt, if sales to consumer is exempt and no tax is charge or Select Sales to Consumer - Taxable if you have charges GST (CGST, SGST or IGST).

If you select exempt then system not calculate any kind of tax in the voucher, of if you select then you have to mention nature of tax i.e. IGST, CGST or SGST. IGST is charge of outside state sales and CGST, SGST charge for local (inside state) sales.

Press Enter to Save the voucher.

Go to Gateway of Tally - Display - Statutory Report - GST - GSTR - 1. There is two type of B2C options, one is B2C (Large) which is used for invoice more than Rs. 2.5 Lacs of inter state sales and other one is B2C Small which contained local sales to consumer even have amount more or less Rs. 2.5 Lacs.

In below video you can easily learn how can we create B2C Large or B2C Small Sales.

Go to Gateway of Tally - Accounting Voucher - Sales (F8).

|

| GST B2C Sales in Tally |

If you select exempt then system not calculate any kind of tax in the voucher, of if you select then you have to mention nature of tax i.e. IGST, CGST or SGST. IGST is charge of outside state sales and CGST, SGST charge for local (inside state) sales.

Press Enter to Save the voucher.

Go to Gateway of Tally - Display - Statutory Report - GST - GSTR - 1. There is two type of B2C options, one is B2C (Large) which is used for invoice more than Rs. 2.5 Lacs of inter state sales and other one is B2C Small which contained local sales to consumer even have amount more or less Rs. 2.5 Lacs.

In below video you can easily learn how can we create B2C Large or B2C Small Sales.

1 Comments

how to enter sales return to bill to composition

ReplyDeleteNo spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.