Today we post on how to treat Late Fees and Interest payment for GSTR 3B in accounts. First we know about the concept of the late fees and interest charge by department in online GSTR 3B and later on waive off. As you know Interest and late fees is the part of expenses and it is debited to direct expenditure account. But if government waive off late fees and interest then paid amount of Interest and Late fees will be appear in your cash ledger (see below pic), in this case, payment made by us of Interest and Late fees will not be debited in expenditure account till it is not setoff in our GST returns.

1st Case

For Example:

XYZ company delay to file GSTR 3B for the month of January 2019 for 5 days. Now, company has liable to pay Late fees for 5 days that means 50 Rs. per day (50 * 5 = 250, Rs. 125 CGST Rs. 125 SGST) and make the payment. Now department waive off the penalty for the month of January via a new notification.

So amount paid by the company as Late fees/ Interest will be appear in his cash ledger (like below image) and it will be available for future setoff.

So in your books this amount not debited to expenses, it will be debited to your current assets (Cash Ledger of your GST portal) and you need to do setoff entry when this amount setoff in your future GST Returns.

Ledger to maintain your Interest & Late Fees as per Cash Ledger is as follows:

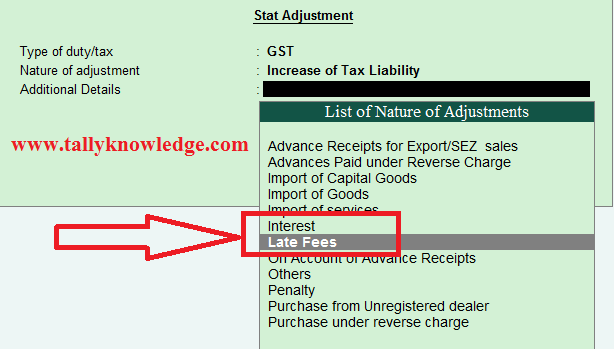

Now pass a journal entry and press Alt + J for GST Statutory Adjustment - Increase of Tax Liability - Select Late Fees / Interest

For interest select Interest from Additional details and for Late Fees select late fees from additional details. Your Journal voucher will looks like this:

Go to your GSTR 3B and check, In column 5.1 Interest and late fees will be appear.

2nd Case

Please watch below video for full tutorial:

If you have any issue in GST Accounting you can contact us at:

Email: tallyknowledge@gmail.com

Facebook: Facebook Fan Page

Youtube: Official YouTube Channel

Whatsapp: 8920287934

2 Comments

How is tds entery enabled in tall

ReplyDeletei understand how to do entry of interest , Late Fees in GSTR 3B in Tally

ReplyDeletetally courses

https://www.zuaneducation.com/tally-training-courses

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.