How to Maintain Bill Wise accounting in Tally?

Generally, accountants use tally to manage their business and compliances, but tally is not only for this. Tally is a broad software which helps you to manage and reconcile each entry and each statement like bank reconciliation, sundry creditors, sundry debtors.

The feature of reconciling bank reconciliation is available in Bank Statement. For Sundry Creditors and Sundry Debtors, you need to enter the bill wise details which is a very powerful feature for manage the parties reconciliation and if you enable this feature then no need to reconcile the party ledger manually. Bill wise details also help you to manager your TDS liability and TDS deducted by the party.

On Gateway of Tally - Press F11 and Select Accounting Features and select yes to Maintain Bill Wise Details

Or you can just press F11 in any voucher entry and then F1 to enable the feature.

There are 2 features under Bill Wise Details

1. Maintain Bill wise details - Allow you to maintain Bill wise details in Balance Sheet Items

2. For Non - Trading accounts also - Allow you to maintain Bill wise details in Balance Sheet and Profit & Loss Items

|

| Enabling Bill Wise Details in Tally |

There are 2 features under Bill Wise Details

1. Maintain Bill wise details - Allow you to maintain Bill wise details in Balance Sheet Items

2. For Non - Trading accounts also - Allow you to maintain Bill wise details in Balance Sheet and Profit & Loss Items

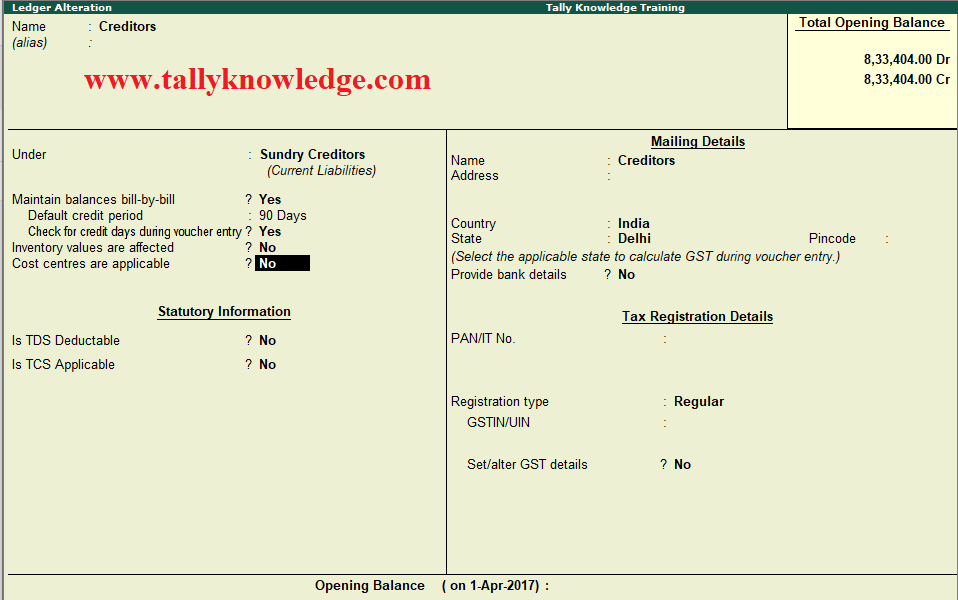

After enabling this feature, you can see a new feature is added in ledger creation/alteration screen.

|

| Bill Wise feature in Tally Ledger Creation / Alteration |

Select yes to maintain bill wise details for any kind of sales/purchase.

Now create any purchase voucher:

|

| Bill wise details in voucher entry |

Now save the voucher entry and go to Display - Statement of Accounts - Outstanding - Payable. Select Sundry Creditors and now you can see the entry passed by you appear here as outstanding (means pending to setoff).

Now again go to voucher entry and select payment voucher, enter party name to dr. field, press enter and enter amount paid to party for which invoice is booked. Press enter and system will show you pending invoices in bill wise details which will be automatically appear as Agst Ref and show you list of bills entered in party ledger and old balance of pending invoices.

Select invoice number for which you want to make payment. If you want to make part payment then enter the amount and save the voucher, the system deducts the only part payment from the outstanding amount and show you the balance amount in outstanding summary.

Now we try to manage the TDS deduction entry with bill wise details.

Pass the same entry of expenses and select TDS ledger also.

Now when you pass the TDS payment entry you can see purchase voucher number (not invoice number) on TDS Field:

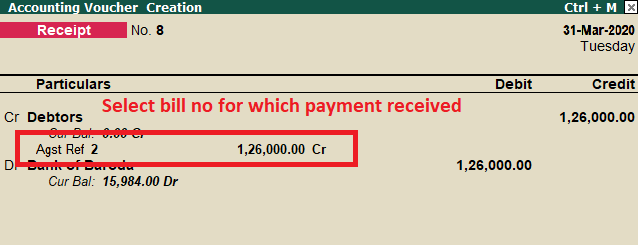

Now the second example is for Debtors. Create a sales entry and save like below image:

Check bill wise details of your debtor through navigate - Display - Statement of Accounts - Outstandings - Ledger - Type your party name. You can see sales bill generated to your party is available here.

When you receive payment of this invoice whether partially or fully, you need to select the invoice no./ ref no. in receipt voucher-like below image:

Receipt entry of 86000 part payment against invoice value of Rs. 126000/-. Now go again to Display - Statement of Accounts - Outstanding - Ledgers. You can easily understand reconciliation conept through below image.

Here is your party reconciliation is complete. You can also manage your debtors in the same method.

Guys if you like our post then please comment or email us: Contact US

0 Comments

No spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.