In GST there is some expenses/ purchases on which Input Credit is not allowed or gst on those expenses is ineligible or there is some stocks on which you cannot get Input Credit. List of Ineligible expenses are as follows:

S. No.

|

Nature of Expenses

|

Exceptions

|

1

|

Motor Vehicle Expenses

| |

A) Dealer of Motor Vehicle

|

If Service provider ( S.P.) and service receiver (S.R.), both are belong to same line of business ( Dealing in motor vehicle) , in such a case S.R. can claim ITC.

| |

B) Passenger transportation / training of driver

|

If this services is directly use in providing main service (output service liability), in such a case ITC can claim, in another case we cannot claim this expenses as input.

| |

C) GTA Services

|

Tax Paid under RCM is allowed as input tax credit.

| |

D) Car Hiring Charges

|

–

| |

2

|

Food and beverage

|

If SP and SR both are belong to same line of business, in such a case S.R. can claim ITC.

|

3

|

Outdoor catering

|

If SP and SR both are belong to same line of business, in such a case S.R. can claim ITC.

|

4

|

Beauty Treatment Services

|

If SP and SR both are belong to same line of business, in such a case S.R. can claim ITC.

|

5

|

Health Services

|

If SP and SR both are belong to same line of business, in such a case S.R. can claim ITC.

|

6

|

Cosmetic and plastic surgery

|

If SP and SR both are belong to same line of business, in such a case S.R. can claim ITC.

|

7

|

Rent a cab services

|

1. In case of similar line of business, credit is allowed.

2. Where such service is mandatory to provide as per norms of government, credit is allowed.

|

8

|

Life Insurance Services

|

1. In case of similar line of business, credit is allowed.

2. Where such service is mandatory to provide as per norms of government, credit is allowed.

|

9

|

Health insurance services

|

1. In case of similar line of business, credit is allowed.

2. Where such service is mandatory to provide as per norms of government, credit is allowed.

|

10

|

Construction services for construction of immovable property

|

If SP and SR both are belong to same line of business, in such a case S.R. can claim ITC.

|

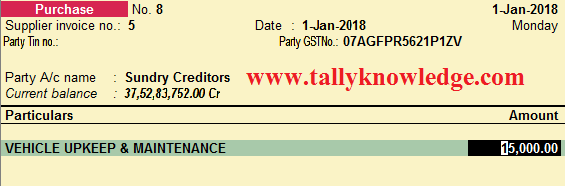

For Example, Tally Knowledge received invoice of Rs. 17700/- including GST @ 18%.

For help with this tutorials please read this also: How to Setup Single Ledger for Multiple GST Tax Calculation

First you need to setup your ledger according to requirement. Alter or create a new ledger for Motor Car service or Vehicle Upkeep of Maintenance. Record a purchase voucher for automatic tax calculation for GST, or otherwise Record a journal voucher for manual calculation.

Enter amount of Taxable Value and press Enter. Following tax classification appear on your screen. Select Nature of Purchase / Expenses and Set yes to Ineligible Input Tax Credit

For this tax classification Please see follow this link: https://www.youtube.com/watch?v=uPpUF-sLgkA

Select Input GST Ledger for Credit Effect and your entry will be look like this:

1 Comments

This comment has been removed by a blog administrator.

ReplyDeleteNo spam allowed ,please do not waste your time by posting unnecessary comment Like, ads of other site etc.